change in working capital formula fcff

FCFF Net Income Depreciation Amortization Interest Expense 1 Tax Rate Capital Expenditures Net Change in Working capital Free Cash Flow Formula from Cash from Operations The cash flow from operations is the starting point for calculating FCFF CFO. FCFF Formula FCFF NOPAT DA CAPEX Δ Net WC NOPAT Net Operating Profit DA Depreciation and Amortization expense CAPEX Capital Expenditure Δ Net WC Changes in Net Working Capital So using the numbers from 2018 on the image above we have NOPAT which is equivalent to EBIT less the cash taxes equal to 29899.

Free Cash Flow To Firm Fcff Formulas Definition Example

FCFF Free Cash Flow to the Firm CapEx Capital Expenditure ΔWorking Capital Net change in the Working Capital t Tax rate.

. Free cash flow decreases. Net CapEx - - Change in Net Working Capital Essentially adding Net CapEx and Net Working Capital What would be the best way to proceed and why. Net Working Capital and FCF Wall Street Oasis Skip to main content.

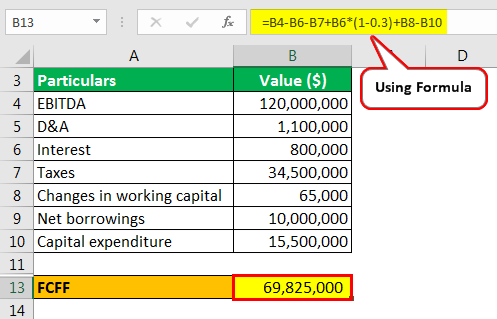

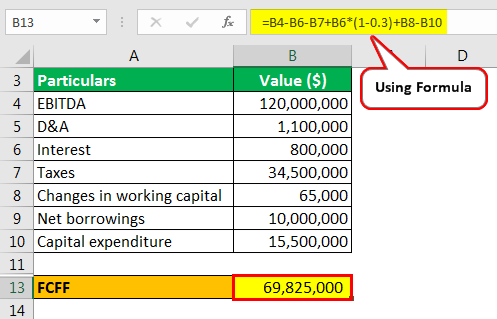

This is EBIT Tax ie. EBITDA Earnings before interest taxes depreciation and amortization Real World Example of Free Cash Flow to the Firm FCFF If we. FCFF EBIT x 1-tax rate Non-Cash Charges Changes in Working capital Capital Expenditure.

FCFF EBITDA 1 TR D TR LI FCFF IWC where. To represent this ST reinvestment we use a metric called change in non-cash working capital. The DA and change in NWC adjustments to net income could be thought of as being analogous to calculating the cash flow from operations CFO section of the cash flow statement.

Here are some examples of how cash and working capital can be impacted. Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. FCFF NOPAT DA CAPEX Changes in Net Working Capital NOPAT or EBIAT Net Operating Profit After Tax ie.

Tax on EBIT DA Depreciation and Amortization non-cash expenses CAPEX Capital Expenditure. The FCFF is calculated using the following formula. By using Formula Operating Profit.

When debt is repaid it consumes cash. The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax. FCFF is calculated using the formula given below FCFF Net Income Non Cash Charges Interest Expense 1 Tax Rate Investments in Working Capital Capital Expenditures CAPEX FCFF 18 20 18 10 10 FCFF 18 20 18 10 10 FCFF 36.

Calculate its Change in Net Working Capital. Changes in working capital are reflected in a firms cash flow statement. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k.

Also how do you get FCF from Net Income. Change in working capital formula fcff Sunday April 17 2022 FCFF Net Income Depreciation Amortization CapEx ΔWorking Capital Interest Expense 1. However at 3 growth.

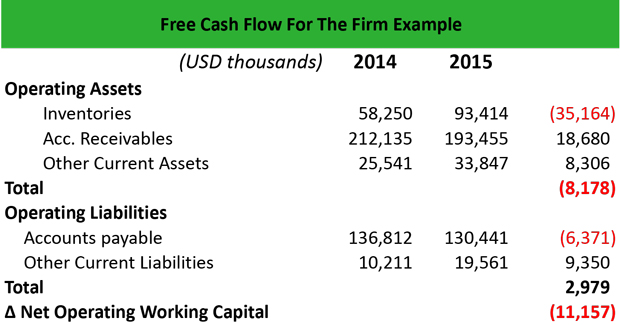

Working Capital 2015 4384 3534 850 million Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital Change in Working capital does mean actual change in value year over year ie. 18819105991263-13102 19192 34245. Since the change in working capital is positive you add it back to Free Cash Flow.

FCFF Net Income Depreciation Amortization CapEx ΔWorking Capital Interest Expense 1 t Where. Discounted Cash Flow DCF is the financial model using which intrinsic value estimation is done. As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year.

Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. The formula comes in handy to compute the sum of money available to pay debt and equity holders. Working capital increases.

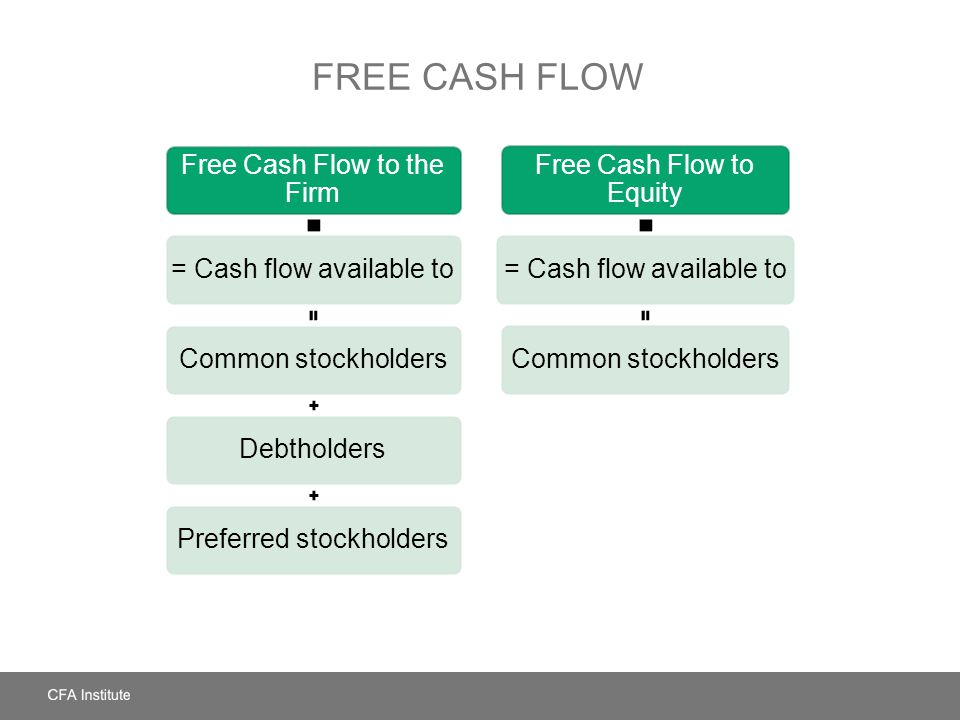

Is it because it is a non-cash item. In a broader sense free cash flow to the firm formula is represented in 3 distinct ways. The mathematical difference between FCFF and FCFE can be seen in this formula.

It means the change in current assets minus the change in current liabilities. FCFF Formula FCFF Net Income DA Interest Expense 1 Tax Rate Change in NWC CapEx Next we add back the relevant non-cash expenses like DA. But the effect of it will.

Therefore Microsofts TTM owner earnings come out to be. FCFF FCFE Net Borrowed Debt Interest 1-tax rate FCF Intrinsic Value FCF is used to estimate the intrinsic value of a company. In an FY if more debt is availed than repaid the cash inflow increases.

FCFEBIT1-t Depreciation Amortisation - CAPEX - Net Working Capital What is the reasoning behind subtracting net working capital. Variables of the FCFF Formula. To get FCF from EBIT the formula is.

The free cash flow to firm formula is capital expenditures and change in working capital subtracted from the product of earnings before interest and taxes EBIT and one minus the tax rate 1-t. If a transaction increases current assets and. Change in Net Working Capital NWC Prior Period NWC Current Period NWC.

Net Working Capital is calculated using the formula given below Net Working Capital Current Assets Current Liabilities For 2017 Net Working Capital 30000 23000 Net Working Capital 7000 For 2018 Net Working Capital 33000 21000 Net Working Capital 12000. Ive looked around and found some people saying that you amend the FCFE formula to reflect the negative change in net working capital by doing the following. Cash Flow to Firm Formula.

When new debt is taken it adds to the cash inflow. The free cash flow to firm formula is used to calculate the amount available to debt and equity holders. Its formula is shown in the above table image.

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow Formula How To Calculate Cash Flow With Examples

Free Cash Flow Meaning Examples What Is Fcf In Valuation

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow Fcf In Financial Analysis Magnimetrics

Free Cash Flow Valuation Ppt Download

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Formula Formula For Free Cash Flow Examples And Guide

Unlevered Free Cash Flow Definition Examples Formula

What Is Free Cash Flow For The Firm Fcff Definition Meaning Example

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-9523034ce2944e6ebef6f54272396bfc.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)